In the fast-paced private equity industry, deal flow management plays a pivotal role in the success of firms. However, in this fiercely competitive marketplace, complacency is simply not an option.

According to a study by PwC, private equity activity experienced a significant slowdown in the second half of 2022. In fact, PE deal volume declined by 22% compared to the previous 12 months, reflecting uncertainty and disruption driven by factors such as inflation, rising interest rates, shuttered debt markets, and geopolitical turmoil. Nevertheless, the industry has shown resilience, and deal volume has now broadly returned to pre-COVID levels.

As private equity firms navigate through this period of slowdown, it becomes crucial to continuously build a high-quality deal flow pipeline to stay ahead and capitalize on lucrative investment opportunities.

In this post, we’ll explore the six best practices for optimizing private equity deal flow to streamline operations and drive superior results. By adopting these best practices, you’ll be able to enhance your deal-sourcing strategies, maximize investment potential, and secure a competitive edge in the dynamic world of private equity.

Use a Private Equity Deal Flow Software

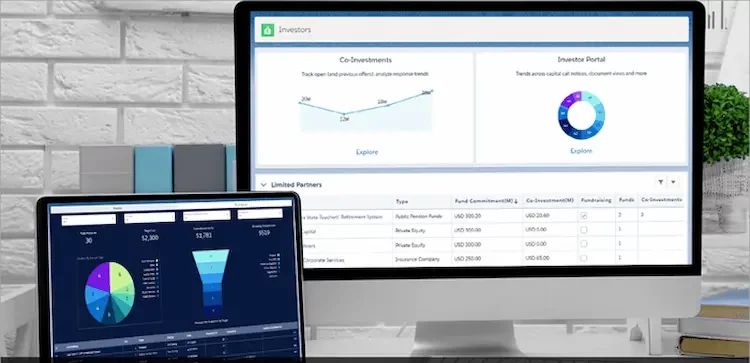

A private equity deal flow software solution serves as a comprehensive solution within the private equity industry, facilitating the efficient management of various processes. This software automates and centralizes deal tracking, collaboration, due diligence, and evaluation, resulting in increased efficiency and improved decision-making. By leveraging deal flow software, private equity firms can streamline their operations, gain a competitive edge, and maximize investment opportunities.

The software enables firms to optimize the deal-sourcing process, maintain a centralized repository of deal-related information, enhance team collaboration, and conduct thorough due diligence, all within a single platform. By providing real-time updates and comprehensive analytics, it enables data-driven decisions to maintain a competitive edge.

Develop a Clear Deal Sourcing Strategy

Crafting a well-structured and concise deal-sourcing strategy holds paramount importance in identifying investment prospects that align harmoniously with your firm’s investment criteria and target sectors. To achieve this, it’s imperative to establish specific investment criteria encompassing factors such as industry focus, company size, geographic preferences and desired financial metrics. By doing so, your private equity firm can streamline its search and concentrate on opportunities that possess the greatest potential for success.

Furthermore, the development of a robust network of industry contacts, coupled with the utilization of online platforms and databases, proves to be an efficacious approach for sourcing enticing deals. Engaging in proprietary research augments the efficacy of these strategies.

Equally valuable is active participation in industry events, conferences, and networking opportunities, as it allows for the establishment of meaningful connections that can pave the way for promising deal flow.

Implement Robust Screening and Filtering Processes

Efficient screening and filtering processes are essential to managing the influx of potential deals and identifying those that warrant further evaluation. Establishing clear and well-defined screening criteria helps quickly assess the suitability of potential investments. These criteria can include financial metrics, growth potential, market position, and alignment with your firm’s investment strategy.

Conducting thorough preliminary assessments and due diligence enables professionals to gather essential information and evaluate the viability of a deal. By implementing efficient filtering mechanisms, such as scoring systems or investment committee reviews, you can prioritize deals based on strategic fit and value creation. This ensures that the most promising opportunities receive the attention they deserve.

Foster Relationships With Intermediaries

Developing and nurturing connections with intermediaries is vital for private equity firms looking to expand their deal opportunities. These intermediaries, including investment bankers, brokers, and consultants, serve as valuable sources for deal sourcing. To access exclusive prospects and secure high-quality deal flow, it’s essential to cultivate strong relationships with these key players.

Establishing a reputation as a trusted and dependable partner is paramount for private equity firms. This can be achieved by showcasing expertise, integrity, and a proven track record. By consistently demonstrating these qualities, you’ll be able to earn the trust and confidence of intermediaries, thereby gaining preferential access to lucrative opportunities.

To foster robust relationships, regular and effective communication is crucial. Engaging in frequent dialogue, participating in networking events, and providing value-added services can help forge deeper connections with intermediaries. This approach not only strengthens the partnership but also increases the likelihood of receiving a steady stream of potential deals.

Furthermore, it’s important to maintain open lines of communication with intermediaries by sharing market insights and offering feedback. By actively collaborating with these intermediaries, you can create a mutually beneficial ecosystem that bolsters the quantity and quality of deals.

Maintain an Organized Deal Flow Management System

An organized and efficient deal flow management system is essential for effectively tracking and managing deals throughout the investment lifecycle. Implementing structured processes for deal tracking, document management, and information sharing is of utmost importance. By centralizing deal-related data, your employees can easily access and retrieve information, ensuring efficient collaboration among deal team members.

Regularly reviewing and updating the deal pipeline enables firms to prioritize actions and make informed investment decisions. Additionally, ensuring confidentiality and implementing robust data security measures are crucial to protecting sensitive deal information. A well-organized system allows for seamless deal flow management, reducing errors and maximizing efficiency.

Continuously Evaluate and Improve Deal Flow Processes

To maintain a competitive edge in the private equity landscape, firms must continuously evaluate and improve their deal flow processes. Periodic assessments of deal flow performance provide valuable insights into the effectiveness of sourcing strategies and filtering mechanisms. Identifying areas for improvement and implementing necessary changes is essential for optimizing deal flow efficiency.

Leveraging data analytics and insights can help firms identify trends, evaluate performance, and make informed decisions. Encouraging feedback and collaboration among deal team members fosters innovation and enhances deal flow processes. Regularly reviewing and refining deal flow processes ensures that firms stay adaptive, efficient, and successful in a rapidly evolving market.

Final Thoughts

Effective private equity deal flow management is crucial for private equity firms aiming to maximize investment opportunities. Embracing technological advancements and adopting best practices enable these firms to navigate the ever-changing business landscape, opening up exciting possibilities and ensuring the achievement of their investment objectives.

With a proactive approach to deal flow management, you’ll be able to stay ahead, seize new avenues for success, and maximize your potential in today’s dynamic and challenging business environment.